Unknown Facts About Investment Advisors

Table of ContentsNot known Details About Investment Advisors Some Of Investment AdvisorsInvestment Advisors Can Be Fun For EveryoneThe 2-Minute Rule for Investment Advisors

4) When intending your retirement profit, it is actually crucial to take taxes right into consideration. Essentially, there are 3 various income tax procedures in retirement life. Along with a very clear revenue plan that takes income taxes right into profile, it may be actually feasible to proactively lessen your tax obligation bill during retired life.Producing intentional retirement life profit strategy selections around income taxes can easily lead in considerable income tax savings for lots of Americans, while disregarding income tax preparing may possess very painful income tax consequences. 5 )The means you spend need to transform as you near retired life. For some Americans, a practical technique is to downsize their property through marketing it, and at that point use a part of the gains to cash retirement.

What Does Investment Advisors Do?

Uncle Sam has made this tactic job coming from a tax obligation standpoint. Presently, if you are actually married, you can easily spare around$500,000 of increases when you offer your residence(this exception is made it possible for every 2 years ). Regardless of why you operate, the added profit you produce will definitely also be actually featured in your strategy as it can easily reduce the volume of properties needed to have to attract down for

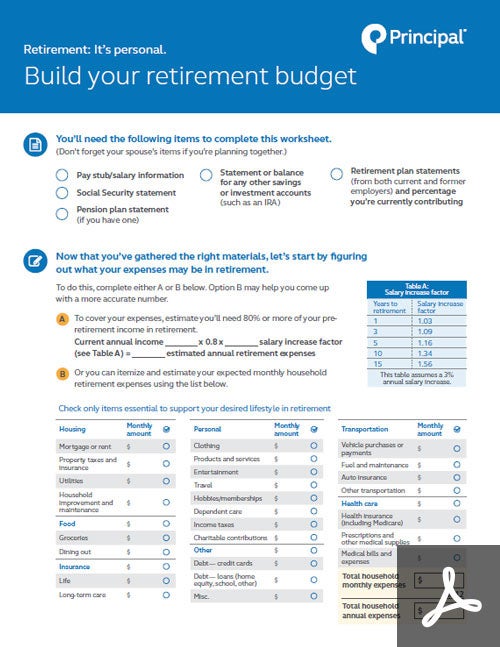

capital. Utilizing your current lifestyle as a bottom, you can easily envision what costs could lessen or go away a kid's university costs or home loan payments, as an example and also which might increase, like traveling or even health care expenses. You may after that create projections about your revenue. What do you count on to receive from your concern in a company or property ownership? Rental property income? Retirement life plans or various other investments? Pension plans? Social Surveillance? For customers whose revenue requirements and demands are relatively very closely matched, it helps to perform exact preparation that predicts the earnings flow and also expenditures for each year.

A pension is actually an insurance product that provides the purchaser along with an assured profit for daily life. When acquiring a retirement life pension, you may do thus as an instant or even deferred possibility. For most much older grownups, immediate allowances are actually even more popular due to the fact that they begin paying within a month of being actually purchased.

If you favor to allow your major boost before receiving payments, you choose a delayed pension. Normally, those facing retirement life will certainly take amount of money gotten throughout their operating years to purchase an urgent annuity. Pensions can be found in numerous forms as well as sizes, so it's most ideal to research study different annuity choices prior to buying one.

Fascination About Investment Advisors

Deposit is actually best, yet without a strategic drawback planning you could possibly find yourself losing your financial savings along with several years left behind to live. Strategic withdrawal consists of a method for withdrawing your Get More Information cash as well as utilizing it as cash circulation along with enabling what you still invite financial savings to carry on to benefit you.

Marketing & Editorial Disclosure Last Updated: 1/26/2023 premium confirmed Quality Verified If you are actually moving in to retirement, the last point you wish to fret about is actually exactly how you'll remain to create amount of money. Finding revenue without working could be made complex for more mature grownups, but it is actually certainly not inconceivable. It is actually important to know your alternatives as well as recognize prospective hoaxes.

A pension is an insurance coverage product that offers the customer with an assured earnings forever (investment advisors). When purchasing a retirement life pension, you may do therefore as an instant or prolonged choice. For many much older adults, find this quick allowances are a lot more well-known given that they begin spending out within a month of being acquired.

Unknown Facts About Investment Advisors

If you choose to permit your main increase just before obtaining payments, you pick a put off pension. Commonly, those encountering retirement life will definitely take money gained during the course of their working years to purchase an instant pension. Annuities are available in many sizes and shapes, so it is actually better to research various allowance possibilities just before acquiring one.

They are actually irreversible: When you get an annuity, you can't modify your mind. Security: Annuities are not had an effect on through stock prices or rates of interest. Allowance market value lessens with time: As an end result of rising cost of living, your investment worth are going to lower with time. Protected income payment: Your income settlement are going to never boost along with an allowance.

Amount of money in the banking company is actually excellent, but without a critical drawback strategy you might find yourself losing your savings with a lot of years delegated reside. Strategic withdrawal consists of a strategy for reversing your cash and also using it as cash circulation besides permitting what you still possess in savings to proceed to help you.